Equipment Loans

When the equipment you depend on isn’t performing the way it used to, it’s time to upgrade. Get new equipment, leverage existing equipment, and refinance old equipment loans with one of our easy financing options.

Equipment Financing

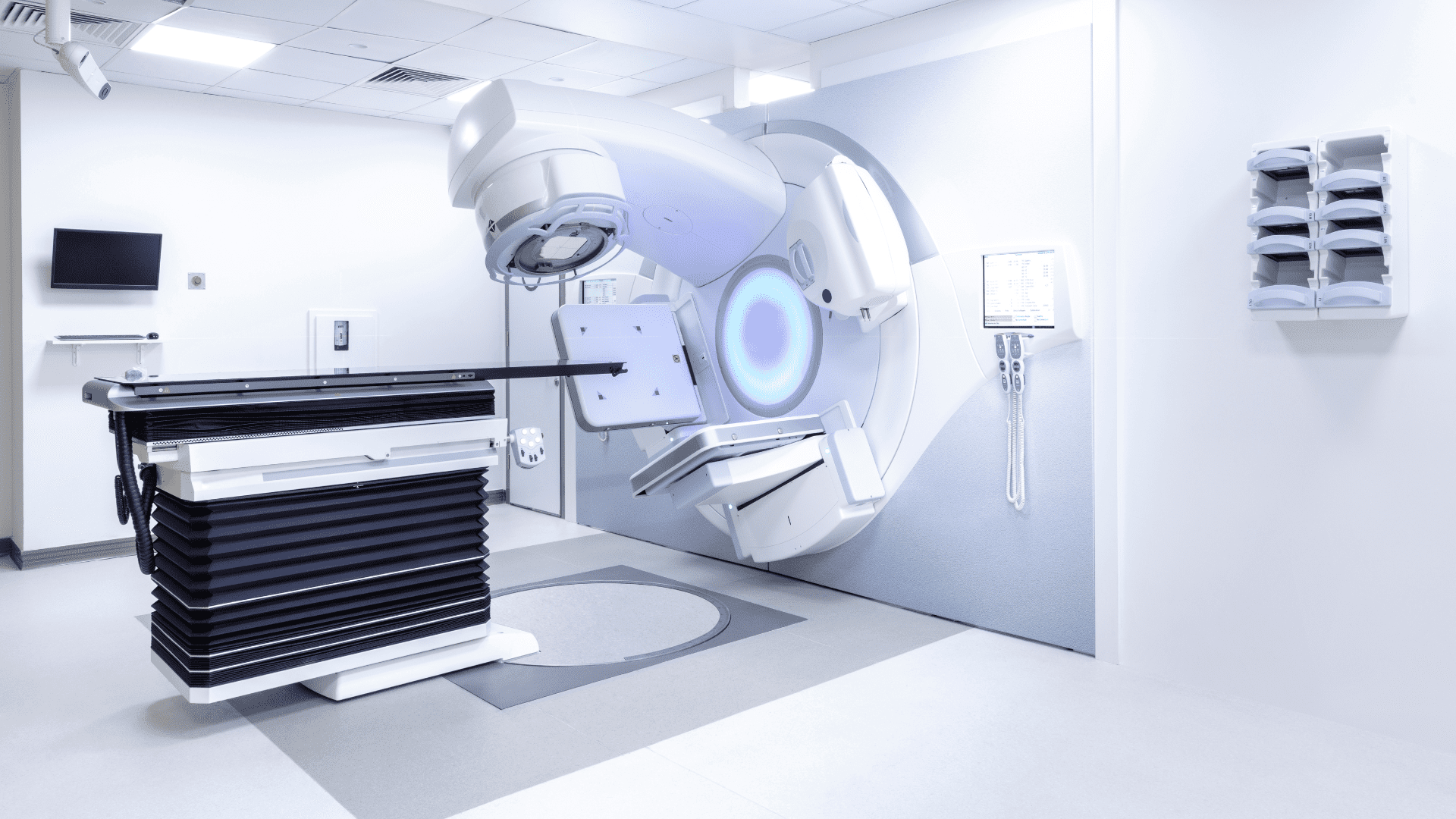

What is Equipment Financing?

Equipment financing is a specialized type of hard money loan structured to help businesses acquire the equipment they need in the operation of their day to day business. Instead of leveraging the loan against assets you already have, these loans are taken out against the equipment being purchased. If your business defaults on the loan, the lender takes the equipment back to resell or to lease.

Equipment loans are fast closing, because the value and depreciation of most technologies are a known quantity. The lender is looking at the value of the equipment, not the credit score of the borrower. This helps businesses because they can access what they need to generate cash flow.

Traditional and Non-Traditional Lenders Available to you

Acquire

Access necessary equipment and technology through acquisition funding. Choose between equipment loans and leasing based on your business goals and the rate of technology advancement in your industry.

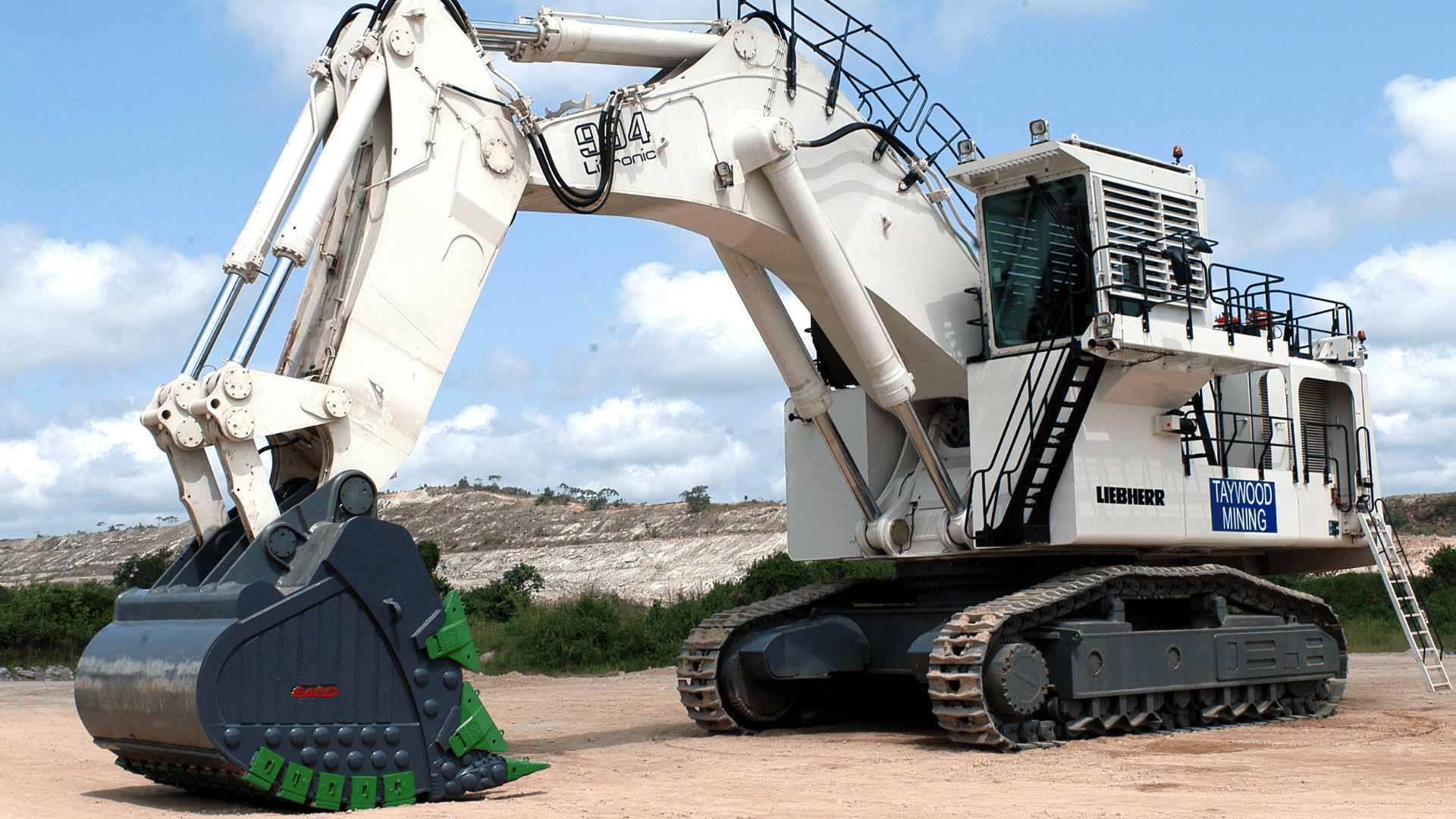

Leverage

Leverage high value equipment to free up working capital for daily needs, acquisition funds for new equipment, or to establish a repair and maintenance budget for equipment already in production.

Refinance

Restructure equipment loans to simplify your budget, decrease cost of money or to lower your monthly payments. If you are considering a refinance, let us help you evaluate your position.

F.A.Q.’s

When is Equipment Financing not a good fit?

How much can I get for my equipment?

Is it hard to get an equipment loan?

We’ll walk you through the documents you need to apply and help you understand terms and conditions.

What is the interest rate for an equipment loan?

Interest rates are impacted by many factors: the type of equipment you are financing, the age of the equipment, your down payment, your credit history, the type of loan, and how much you need to finance. Interest rates start as low as 5%. Let us know your needs and our team will work to match you with the lowest cost lenders for that type of equipment.

Equipment Financing

Advantages

Break high upfront costs into manageable payments.

Computers, ovens, vehicles, printing presses, & more qualify.

Motiva Capital

Apply Today

Motiva Capital is your bridge to capital. Work directly with brokers who have been in your shoes. Let us show you what we can do for your business.

52 Tuscan Way Suite 202 Saint Augustine, Fl 32092

Fax: +1(786) 358-6083.