INTERNATIONAL FINANCING

What IS INTERNATIONAL Financing?

Motiva Capital focuses on funding in three main areas: Commercial Real Estate acquisition, construction and refinancing. Our international lending partners fund projects from $50M to $1B+

Additional International funding types include trade and supply chain financing, revolving and term lines of credit, working capital, term loans, asset-based financing, and customized specialty financing built around your unique project or business model. Speak to us about opportunities for funding for operational financing opportunities.

To access international business funds often requires an involved process that can become lengthy if the borrower is inexperienced. Motiva Capital’s background in international business and our relationships with high-quality international lenders help you shorten the time to funding. Further, our approach provides you expert insight into the lenders, loan types, risks, opportunities and benefits of taking out an international commercial loan.

Traditional and Non-Traditional Lenders Available to you

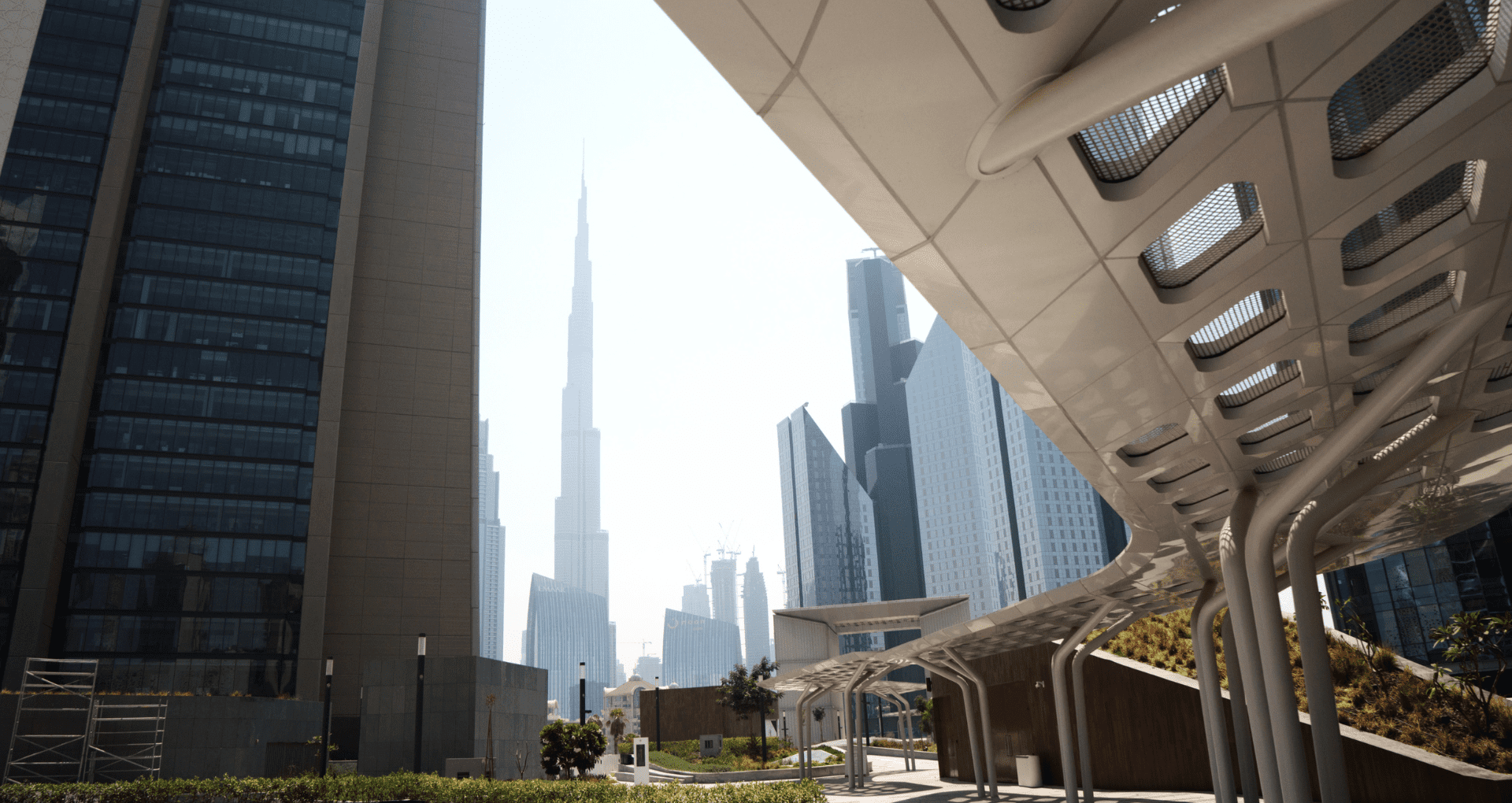

Acquire Properties and Assets

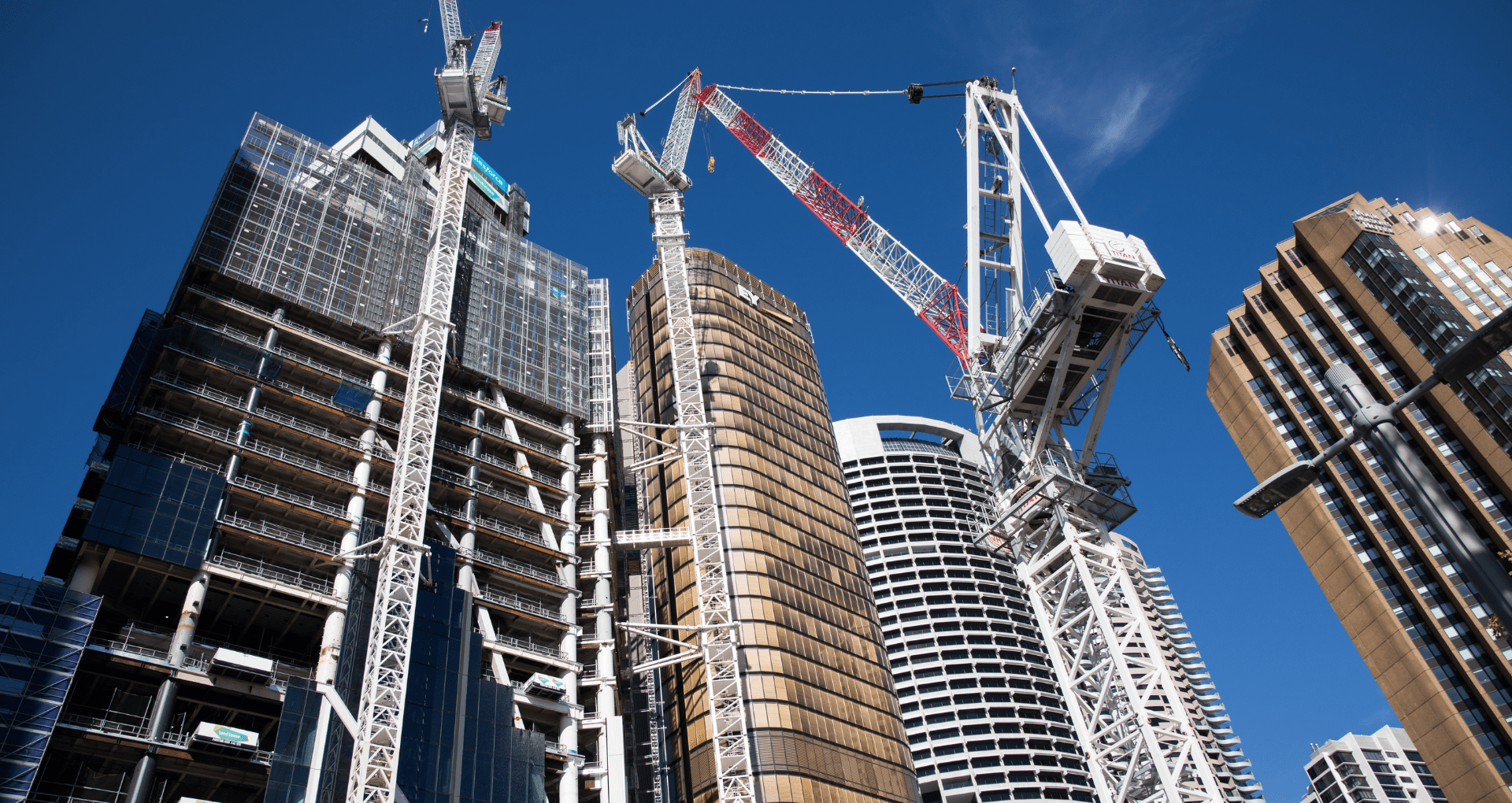

Build International Properties

Refinance International Properties

F.A.Q.’s

When is international financing not a good fit?

When the business is able to finance the entire project with investor funds, international financing may reduce the return on investment due to interest. However, international loans may come with added protections such as site inspections that can identify and correct work before the next stage of development can proceed. Talk to us to determine if adding international financing to your capital stack is a good fit.

Who funds international loans?

Who needs international loans?

Are international loans hard to get?

International Financing

Advantages

Loans are made through collaborative bank and lender relationships that allow investment funds to cross borders.

International loans allow small and mid sized businesses to gain the benefits of becoming a part of multi-national markets.

Motiva Capital

Apply Today

Motiva Capital is your bridge to capital. Work directly with brokers who have been in your shoes. Let us show you what we can do for your business.

52 Tuscan Way Suite 202 Saint Augustine, Fl 32092

Fax: +1(786) 358-6083.